Homeownership remains one of the most significant ways to build wealth in the United States. It provides a stable and secure foundation for individuals and families to grow their assets and improve their financial wellbeing. One of the key drivers of wealth creation through homeownership is appreciation, or the increase in value of the property over time.

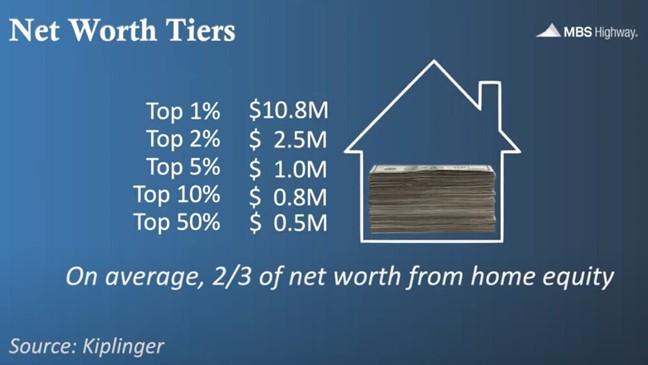

As Barry Habib, a prominent mortgage industry expert, has pointed out, “The biggest mistake people make is not buying a home because they think it’s too expensive. They don’t realize that two-thirds of all net worth in the US is from home equity.” This statement highlights the critical role that homeownership plays in wealth building, with home equity being a significant contributor to overall net worth. The Kiplinger report below shows the Net Worth by tiers. The top 50% have a net worth of half a million which is just the median home price of $428,700. So before you make an annual income, it’s likely that you’re in the top 50%.

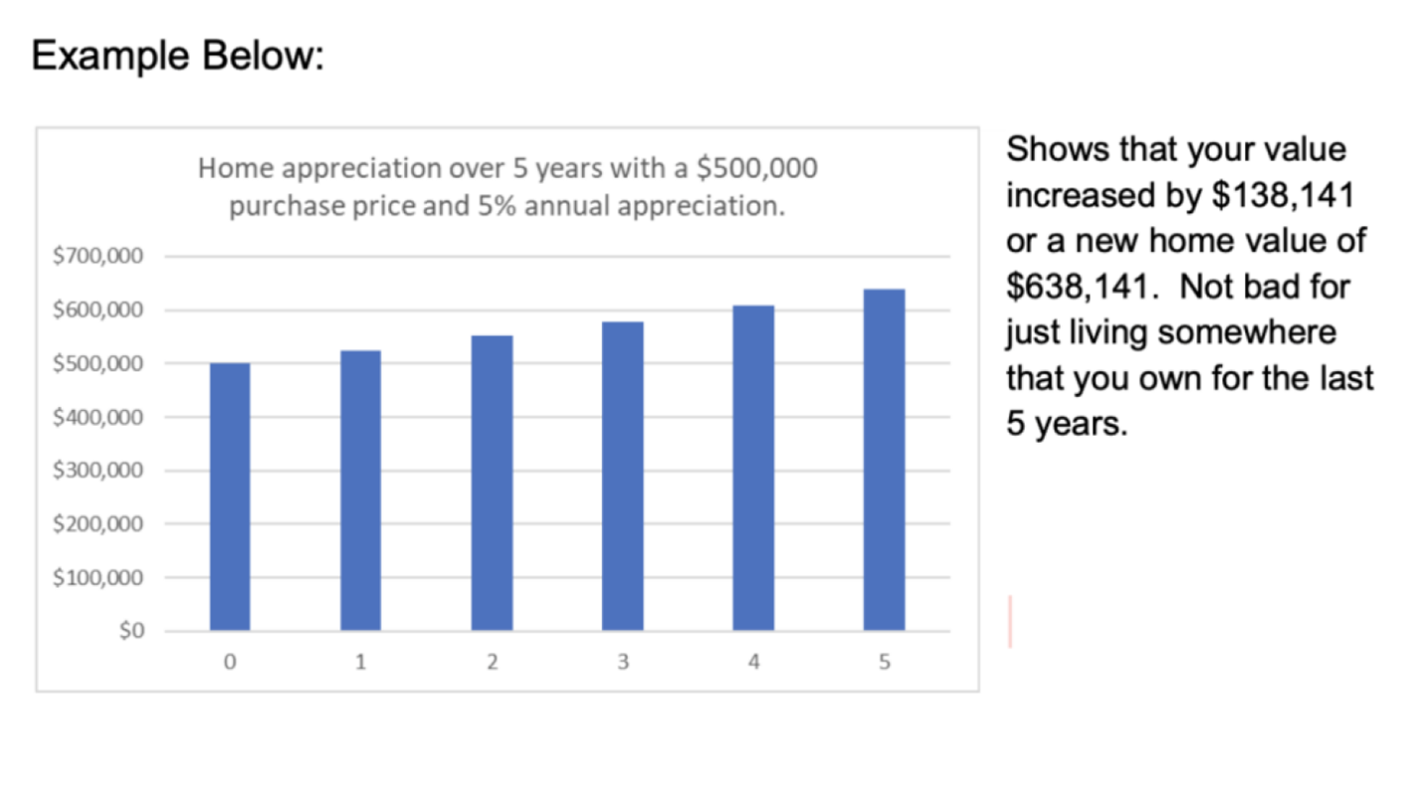

Appreciation is a major factor in the accumulation of home equity, with homes increasing in value over time due to various factors such as location, market conditions, and improvements made to the property. Homeowners who purchase their properties and hold on to them for an extended period are likely to experience significant appreciation, which can translate into substantial profits upon sale. Historically, real estate has appreciated at a rate of 3-5% per year, and this was increased to 17.5% in 2020 and has settled to a more stead rate of 4.5% by the end of 2024. This appreciation can significantly increase the homeowner’s wealth over time.

The right time to buy is ANYTIME since home values have increased 75 years out of the last 83 years with the last drop taking place in 2011 as part of the Great Recession. In addition to appreciation, homeownership offers other opportunities for wealth building, such as equity accumulation, tax benefits, and savings on rental expenses. By making regular mortgage payments, homeowners increase their equity in the property, which can be accessed through a home equity loan or line of credit or used to finance future purchases.

In conclusion, homeownership is a powerful tool for wealth building, with appreciation being a significant driver of home equity and overall net worth. As Barry Habib noted, two-thirds of all net worth in the US is from home equity, highlighting the importance of owning a home as a means of building wealth and achieving financial security. If you are interested in making your net worth more by owning real estate, give Callaway Home Partners a call at 407-496-6879 for Mary or 321-947-5573 for Scott.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link